News, Opinions & Events

Luntz: Second shutdown over health care would be ‘very painful’ for Republicans – Hill

Almost heaven?:

“Effectively, he said, the extra money that people had to work with thanks to the subsidies would vanish, putting families and the Tobys and Ediths in the country under more financial strain. ‘That’s how they think, you know,’ Justice said. ‘And so what I would say to you is, if Republicans aren’t concerned about that, they’re making a bad move on the chessboard.'”…

Sen. Justice knows what he is talking about. As West Viriginia’s Republican governor from 2017 to 2025, he ran the state’s Medicaid program and health exchange. Almost half of the state population depends on government-provided health insurance (25% on Medicaid, 20% on Medicare). In 2025, enrollment in the state exchange grew by 31% to 67,113 – the second highest growth rate among all states. With a relatively older and poorer population, West Virginia faces many health care challenges including unmet medical needs. More than 6% of state residents have no health insurance.

Need health coverage?

Resources:

Who is eligible for Medicaid in West Virginia?

Contact your US senators and House members.

How a landlord responded when tenants formed a union, stopped paying rent – msn/WaPost

“…But there are risks. In Missouri — and most of the country — renters lack legal protections, and tenants like Barlow face eviction and homelessness if their strategy fails. The California-based real estate company Alta/CGHS, which owns Bowen Tower, has sent eviction notices to 28 tenants since the rent strike started and is refusing to renew some leases…”

Housing Perspectives: Our Top 10 Blogs of 2025 – Harvard JCHS

The Most Important Immigration Stories of 2025- David Bier/Laissez-Faire/Laissez-Passer

“From banning legal immigrants to deporting them to profiling Americans.”

At the local dog park, Trump voters were reassuring: “They are not after people like you…”

Remember?

“Hamas conveys ‘business as usual’ despite losing most of its leadership and control of around half of Gaza. However, its narrative is seen as disconnected by a public in dire need of basic humanitarian aid and leaders who value life over ‘resistance and liberation’.”

Israel to block dozens of aid groups working in war-battered Gaza – Al Jazeera

“Aid groups facing bans include MSF and Oxfam as European countries sound the alarm over dire humanitarian situation.“

A cry for help to save Gaza’s healthcare system – Al Jazeera

“I start my shift at al-Shifa Hospital’s emergency ward at 7:30am, and I stay at the hospital for a full 24 hours. During that time, there is a constant stream of patients, from heart attacks to hypothermia to chronic diseases that have suddenly worsened due to the lack of treatment for traumatic injuries from Israeli attacks…

“Medical teams are working in an environment lacking almost everything: essential medicines, ventilators, functioning operating rooms, and even beds. This is compounded by a severe shortage of spare parts for broken medical equipment, meaning that even a minor malfunction can halt the treatment of dozens of patients.

“There are 350,000 people with chronic illnesses, the majority of whom are unable to receive their regular treatments. There are 42,000 people with life-changing injuries who require multiple surgeries and/or long-term rehabilitation, which is inaccessible in Gaza. There are more than 16,000 patients who require urgent medical evacuation; nearly 1,100 have died while waiting to be allowed to leave for treatment.

“Meanwhile, Israel continues to bomb civilians and block the delivery of essential and life-saving medications, including cancer drugs, supplies for dialysis, heart medications, antibiotics, insulin, and emergency care IV solutions.”

“No Place Under Heaven”: Forced displacement in the Gaza Strip, 2023-2025 – B’Tselem

“There are no half measures. Rafah, Deir al-Balah, Nuseirat – total annihilation. ‘You will blot out the remembrance of Amalek from under heaven’ – there’s no place under heaven.” – Israeli Finance Minister Bezalel Smotrich, April 2024

How JD Vance brokered peace between Trump and Elon Musk – Independent/WaPost

MTG says one line in Trump’s eulogy to Charlie Kirk was ‘the worst’ – Independent

Trump and the Republican overlords continue to fight and fume, threatening a party rupture. But contrast their energy with the politically correct Democrats and their pronouns. Mamdani’s win in New York is a sign of life — then again, he is not even a Democrat.

Meanwhile, Trump & Co. are getting richer…

3 Ways Trump’s Wealth Has Soared Since He Returned to Office – TIME

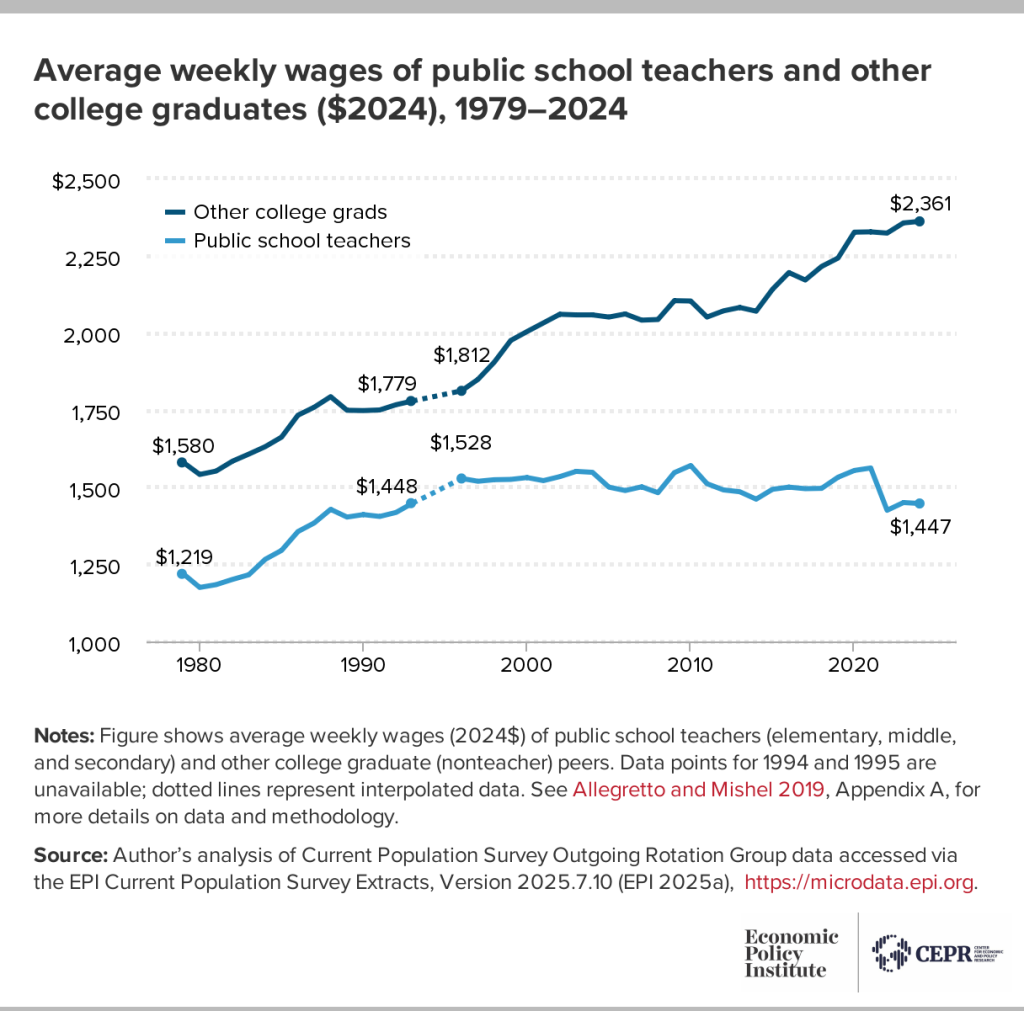

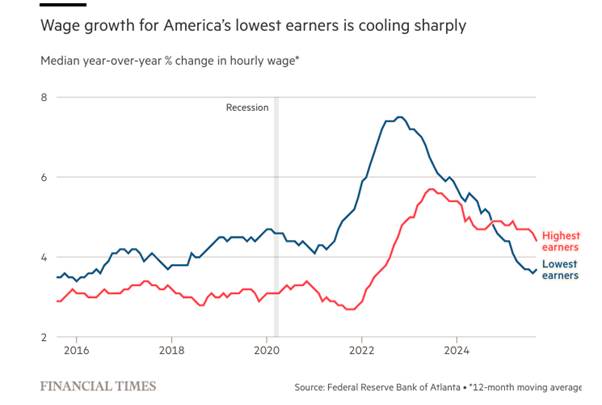

To regain working class support, the Democratic Party needs to move to the left on economic issues and the center on cultural issues. That means moving away from identity politics and fighting equally for all struggling people regardless of color or sexual identity. In recent years, leaders from both parties have prioritized the wishes of higher-income people sitting alongside them in policy discussions. It’s time to take a close look at what the rest of the country needs.

Despite Trump’s War on Workers, Labor Movement Notched Crucial Wins in 2025 – truthout

What we learned about the state of the Trump coalition in conversations with 50 voters – NBC

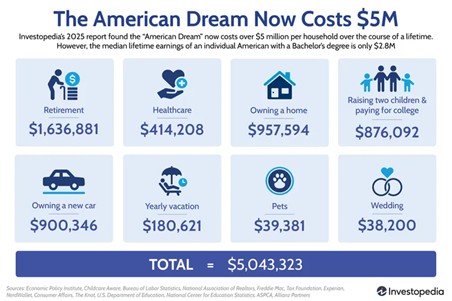

How the bottom half lives:

The wondrous, short-lived dream of the MVP1 toilet – Chico Harlan/msn/WaPost

“…In many parts of the world, people flush without a thought. But almost half of humanity doesn’t have that luxury, leaving them exposed to life-threatening diseases and compounding social and economic problems…”

Bucket Toilets: Advantages And Disadvantages/DIY Housebuilding

Trump and Netanyahu are to meet in Florida at a crucial moment for the US-backed Gaza ceasefire – AP

Nearly four in 10 US Jews say Israel has committed genocide in Gaza – Times of Israel

“Young Jews increasingly alienated from the Jewish state”

“WaPo survey also finds 68% blame Hamas more for civilian deaths; 76% say Israel’s existence is vital for Jewish future; 31% feel unsafe in US; two-thirds have negative view of Netanyahu.”

Top ten posts of 2025 – Michael Roberts

“There were three posts in the top ten that focused on the US economy and the likely impact of Trump’s tariff policies…”

Policymakers Must Address Earnings Instability – CPER

“There are two policy pathways that could potentially ease stress over unstable work hours and incomes. First, local, state or federal policy measures could support workers in low-wage jobs with frequently unpredictable scheduling. Currently, several cities — such as San Francisco, Emeryville, Seattle, New York City, Philadelphia, Chicago, Evanston, Berkeley, and Los Angeles — and one state (Oregon) have passed scheduling laws. At least ten states have considered the legislation.

“Second, a monthly child allowance is another option for policymakers concerned about those with children — particularly unmarried parents in low-wage jobs — and wanting to offset some financial stress caused by work-hour insecurity.”

Study: Wages drive 95% of upward financial mobility, not investments – msn

“In A Nutshell

- Researchers tracked nearly 300,000 Norwegians over 26 years and found that 95% of people who moved up the income ladder did so through wage increases alone or wages plus investment gains—only 5% rose through investments alone.

- For those who climbed through both income sources, wage increases averaged $38,000 while investment gains averaged just $9,200, with the typical person seeing wages rise by $31,000 versus investment income of only $308.

- The pattern reverses on the way down: capital losses played a bigger role than wage cuts when single income sources drove people down the income rankings, while about half experienced declines in both simultaneously.

- The asymmetry exists because wages follow predictable career progression patterns while investment income is highly concentrated, volatile, and exposed to sudden losses from market downturns and business failures.”

Gaza’s New Normal: Persistent Limited Conflict Is More Likely Than Peace – Daniel Byman/Foreign Affairs

Sea change?:

Chris Van Hollen isn’t afraid to take a stand against Israeli brutality – Hill

“…Polls show that an increasing number of Jews, particularly progressives and young people, oppose Netanyahu’s policies and support Palestinian rights. So do most Americans overall…”

Members of GU Jewish Community Publicly Oppose Deportations – Hoya

“…Wessel said she signed the letter to make it clear that members of Georgetown’s Jewish community oppose Israel’s actions in Gaza and the Trump administration’s deportation efforts…”

Elise Stefanik’s fall from grace and favor is a cautionary tale – Haaretz

“Elise Stefanik’s embrace of Donald Trump seemed set to earn her the Republican nomination for Governor of New York. But now the lawmaker who rose to fame by labeling pro-Palestinian campus protests as antisemitic, is facing the downside of aligning too closely with the famously transactional president.”

In first Christmas sermon, Pope Leo decries conditions for Palestinians in Gaza – Reuters

Just asked the internet/AI: “Who is the first child born in Gaza on December 25, 2025? Got this response:

“The first child born in Gaza on Christmas Day 2025 is not explicitly mentioned in available sources.”

The American Evangelical Pastors Supporting Genocide in Gaza – CounterPunch

Dear VP + possible Trump successor Vance: If you can get past the “white men” BS intro, this short article and the slaughter/starvation/land theft in Gaza and the West Bank challenge your statement that the US “will always be a Christian nation.” Read the NT + 10 commandments, ask the Pope, watch the streaming…

References:

Check out #s 6 and 8 (and the first two if your religion is capitalism or socialism):

Condensed version:

A New K in America – Paul Krugman

“The gap between haves and have-nots fell under Biden, but is rising under Trump.”

Why so many Americans dislike this fast-growing economy – CNN

Ferguson backs income tax on WA residents earning over $1M – WA State Standard

“The so-called ‘millionaires tax’ could raise $3 billion annually, starting in 2029. It would likely face legal challenges and need to go to voters for approval.”

“If the tax is adopted, Ferguson said he wants to explore limiting sales taxes on personal hygiene products, like shampoo, deodorant and toothpaste, as well as eliminating the levies on baby products, like formula and diapers, and ‘essential and affordable clothing items.’

“‘Progressive tax reform cannot just mean increasing contributions from those who can afford it,’ Ferguson said. ‘We must use the gains from the millionaires tax to return money directly to working families and small business owners who have been hit hard by the affordability crisis.'”

Trump administration to resume student loan wage garnishments – Newsweek/WaPost

“According to a report from the Education Data Initiative in August, around 42.5 million student borrowers hold federal loan debt, with a total outstanding balance of nearly $1.7 trillion.

“Prior to resuming collections on defaulted payments in May, the Department of Education estimated that more than 5 million borrowers had not made a monthly payment in over a year—placing them in default—and that 4 million were in late-stage delinquency.”

401(k) millionaires hit record numbers but expose America’s two-tier economy – msn

“UBS data shows 52 million retirement millionaires worldwide, but consumer sentiment crashes to recession levels as America splits into two economic classes.”

How the Emerging U.S. Retirement Saving System Magnifies Inequality – Washington University

Donald Trump’s Approval Rating Flips With Least Educated Americans – Newsweek

The poverty line is a lie: how the rising cost of living is leaving many Americans behind – MS Now

“Donald Trump tried to use his address to the nation to gaslight the country into thinking that the economy is doing better than it actually is. Despite what he says, the cost of living is much higher than it used to be and many people in the lower rungs of society are being squeezed out by the one-two punch of rising prices and the shrinking social safety net.”

A middle-class family’s only option: A $43,000 health insurance premium – msn/WaPost

“C’est moi.”

Sen. Rand Paul does not want Vice President J.D.Vance to be the next president – Washington Times

Vance tries to weather the MAGA storm at Turning Point – Politico

This early in President Trump’s second term, does suddenly surging debate about JD Vance as the 2028 Republican presidential candidate also reflect growing concern that the VP might be called to replace the president sooner?

Political calculus:

y = f(x), where: y = probability of DT resignation/impeachment

x = (Trump mental, physical, moral fitness) + (US economic pain index/eg health exchange blow up) + (political scandal/Epstein files) + (who knows what?)

Sunday, December 21, 2025

Exploring the Concept of Justice in Different Religions – Legal Reader

“He has shown all you people what is good. And what does the LORD require of you? To act justly and to love mercy and to walk humbly with your God.” – Micah 6:8

Featured

Beware of Republicans bearing cash!

Substituting Cash for Health Insurance Can Drive Up Costs, Medical Bankruptcy – Karl Polzer/CCSE

Not! (for now)

Senate GOP health care plan fails on mostly party-line vote – Hill

As suspected, the two health care subsidy votes were performative art organized by Senate leaders setting a high bar (60/100 votes). Clock’s still ticking for millions of Americans needing health insurance they can afford.

Health Care–Related Savings Accounts, Health Care Expenditures, and Tax Expenditures – JAMA

“Conclusions and Relevance: Participation in FSAs is associated with higher health care expenditures and tax expenditures, while HSAs are not associated with reduced expenditures. Tax policy could be better targeted to enhance insurance coverage and health care accessibility.”

Submitted to Finance Committee Hearing: “The Rising Cost of Health Care: Considering Meaningful Solutions for All Americans”

“No matter how many adjustments the government might make, giving people money to leave the risk pool and bargain on their own with the players in health system undermines the basic concept of insurance – which is pooling risk and resources to make hard-to-predict future expenses more affordable.”

“Understanding Inequality” – a seven-part series by CUNY Stone Center on Socio-Economic Inequality scholar Paul Krugman

- Part I: Why Did the Rich Pull Away from the Rest?

- Part II: The Importance of Worker Power

- Part III: A Trumpian Diversion

- Part IV: Oligarchs and the Rise of Mega-Fortunes

- Part V: Predatory Financialization

- Part VI: Wealth and Power

- Part VII: Crypto

At least two think tanks are holding meetings this month on how to address Social Security’s financing shortfall.

Updated Oct. 8, 2025

“This paper presents options – some favored by conservatives, others by progressives – as a framework for negotiating an equitable solution to Social Security’s financing shortfall. Taken together, the changes could generate up to twice as much in savings and revenue as needed to balance Social Security’s books…

“Congress could strike a deal drawing about half the savings needed to fix Social Security through a gradual benefit reduction by changing the formula for determining initial benefit levels while protecting the lowest earners. The rest of the gap could be filled through tax increases. These financing options provide room for targeted benefit improvements to help the lowest income pay their bills and families raise children.”

Thanks to The Hill for running our oped:

Judge says Trump administration ‘used antisemitism as a smokescreen’ against Harvard – USA Today

Trump Administration’s Cuts to Harvard Funding Are Unconstitutional, Judge Rules – msn/WSJ

CCSE correspondence with Harvard President Garber

“Prediction: Harvard University will be teaching students from all over the world long after what remains of Trump and his brain trust rest in silence beneath the ground. BTW, White House staff could benefit from taking free public finance courses at Harvard’s Kennedy School of Government. Harvard has a positive fund balance. The United State government, not so much.”

No peace, no prize. – Karl Polzer

“Republican members of the US Congress, which is financing Israel’s now escalating ethnic cleansing of Gaza, have nominated President Donald Trump for the Nobel Peace Prize. It is hard to fathom the depth and irony of their fawning depravity. The Nobel prize is clearly a trophy that he covets. But shouldn’t a peace prize have something to do with reducing conflict and killing? The US president and Congress, including a majority of Democrats, are doing the opposite of making peace. They are facilitating Israel’s daily, systematic killing, starvation, and displacement of entire populations of Palestinians in Gaza and the West Bank…”

“Economists and business analysts increasingly agree that Trump’s tariffs are raising prices. There is far less awareness that the historic spike in tariffs – coupled with the tax cuts just made permanent by Congress – comprise a major shift in the tax burden. Taken together, these two changes promise to make the US tax system more regressive. In our increasingly unequal country, taxpayers at the bottom of the economic pecking order are taking on proportionally more of the tax burden as the well-off shoulder less…”

New capitalism III: Capital – Branko Milanovic

“Why is capital so concentrated and why so few have it?”

“The new capitalism has even in the rich countries failed to produce what Margaret Thatcher, and Friedrich Hayek before her, called ‘property-owning society’. (For good measure, Thatcher added ‘democracy’ too.) Even when we include income from forced savings that becomes pension wealth, between one-half and almost 90 percent of the population in rich countries are financial-capital destitute. That percentage becomes more than 90, or even more than 95, in less developed countries…”

Related CCSE work:

Half of Americans have no retirement savings — here’s how Congress can look after them …. op-ed

How the U.S. Retirement Saving System Magnifies Inequality – Society of Actuaries

New Capitalism in America: Richest capitalists and richest workers are increasingly the same people – Global Inequality

Branko Milanovic: The World Under Capitalism – Stone Center/Toronto Public Library

Prof. Milanovic discusses two types of capitalism – “liberal capitalism” in the US and “political capitalism” directed by the Chinese Communist Party. Both systems have produced relatively high levels of income inequality.

Comparing United States and China by Economy – Statistics Times

Just-enacted 2025 budget legislation makes Trump’s 2017 tax cuts permanent. Here’s a CCSE presentation from just after Congress passed that bill:

What has changed? Remains the same?

2025 Social Security groundhog day:

US needs $28 trillion more over 75 years to pay promised benefits

“A few months after the Trump Administration chain-sawed Social Security’s leadership and staff, four newly installed senior officials overseeing the program released the annual report on its declining financial condition. This year’s actuarial forecast is a bit gloomier due in large part to a benefit expansion enacted by the previous Congress. However, in the big picture, not much has changed. Social Security’s looming insolvency remains…

“As I have pointed out to the Senate Budget Committee, the process of spending down Social Security reserves already is increasing overall federal spending and pushing up annual deficits. Drawing down reserves in the Social Security trust funds requires the Treasury to sell bonds (or find other sources of revenue) to raise cash to pay the program’s 74 million beneficiaries.

“On pp. 51-52, this year’s report estimates that Social Security will draw down $181 billion from the combined trust funds in 2025 with the amount rising to $405 billion in 2033. As a result, the federal government is gradually moving to finance part of the program’s benefits through newly issued debt substituting for now-insufficient payroll taxes...”

More on these issues can be found in these CCSE articles and testimony:

- Why Social Security’s big benefit cut won’t happen: The U.S. Treasury already is filling its funding gap – statement to U.S. Senate Budget Committee

- A ‘conservative/progressive’ path to Social Security solvency: bend the benefit cost curve, grow revenue, and protect lower earners – statement to Senate Appropriations Committee

- A Widening Gap in Life Expectancy Makes Raising Social Security’s Retirement Age a Particularly Bad Deal for Low-Wage Earners – Society of Actuaries

- Growing inequality has shrunk Social Security’s revenue. Revitalizing its tax base could help restore solvency without cutting benefits.

- Center on Capital & Social Equity work on Social Security and retirement savings (updated January 2025).

OBBBA’s 30-Year Price Tag – CRFB

“The House-passed One Big Beautiful Bill Act (OBBBA) would add $3 trillion to the debt through Fiscal Year (FY) 2034 as written and $5 trillion if made permanent. Over the long run, it would add far more to the debt.”

Trump, Tariffs, and the Economic Outlook – AEI discussion

“Helping young people learn how to save and build up money for college and adult life are worthy goals. But new ‘Trump kids accounts’ embedded in the massive Republican tax and spending bill before the US Senate not only duplicate existing programs. They also would widen financial gaps between families in our already very unequal country. In addition, tax subsidies for money invested in Trump accounts would go mostly to well-off families and push up the national debt…”

Letter to US citizens:

Student expulsions are an attack on all Americans’ freedom of speech

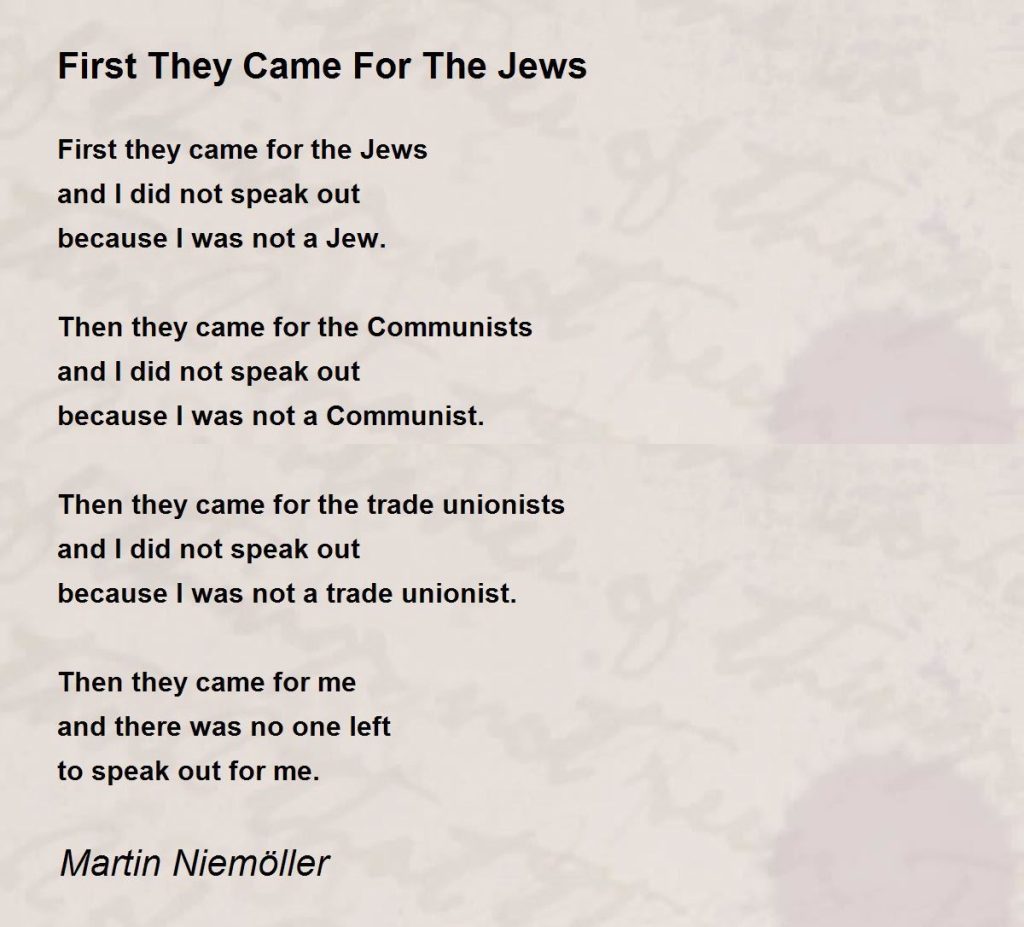

“This is how fascism happens. First, they come for the powerless. In time, they

will come for you.”

“The federal government has had authority since 1986 to criminally prosecute individuals and companies employing workers not legally in the United State, but it has rarely used that authority regardless of the administration in office. A one-year snapshot taken during Trump’s first term found that no company was criminally prosecuted for having workers not authorized to be in the country, a Syracuse University study shows…

“Changing the equation to incentivize employers to help enforce, rather than skirt, the nation’s immigration laws does not mean subjecting them to cruel and unusual punishment. No need to suspend billionaires and entrepreneurs in cages from a tower or use branding irons. It does mean applying and stiffening laws against hiring illegals and tax avoidance. Financial penalties, public shaming, and loss of contracts could be a start. If that isn’t sufficient, start putting law-breaking employers in jail. They are lining their pockets by stealing jobs from American workers, both native born and those immigrating legally.”

Multiple conflicts of interest:

“By directing a high-powered federal agency working to alter the size and nature of the federal workforce, Elon Musk may be jeopardizing the ability of companies he owns and directs, including SpaceX and Tesla, to contract with the federal government.”

Thanks to the Virginian-Pilot for running our op-ed:

Many questions, few answers about exempting tips from taxes – Karl Polzer/Virginian-Pilot

“Gov. Glenn Youngkin’s proposal to exempt tipped income from state taxes — like President-elect Donald Trump’s on a national level — could help some low-wage workers. However, it also poses risks for others and raises complex issues facing scrutiny as the state legislature begins its work…”

To provide access to all readers (the newspaper’s op-eds are gated), below is the original submission including links to sources:

Statement to 11/20/24 US House Appropriations Committee hearing on Social Security:

“As keeper of the federal government’s purse strings, the House Appropriations Committee plays a part in maintaining Social Security’s commitment to American workers, their families, and taxpayers. First, Committee members can weigh in as Congress and the Treasury find hundreds of billions of dollars annually in cash outside the appropriations process to draw down Social Security reserves. The Committee can also help ‘leave room’ in future budgets for revenue increases that might be necessary to keep Social Security solvent as it coordinates with House Ways & Means, Budget, and other Committees on tax and spending issues.”

The next President and Congress will face daunting fiscal issues. In the shadow of historic levels of national debt, lawmakers will be bargaining over trillions of dollars of taxes and spending as they deal with expiration of the Trump tax cuts. On top of that loom major Social Security financing gaps. Paying promised benefits will require the government to raise more than $2 trillion in cash over the next eight years and more than $24 trillion to achieve long-run solvency.

This paper presents policy options – some favored by conservatives, others by progressives – as a framework for negotiating a solution. Taken together, the changes could generate more than twice as much in savings and revenue than needed to balance Social Security’s books.

The nation’s biggest banks in effect have become today’s payday lenders.

Which U.S. Households Have Credit Card Debt? – St. Louis Fed

46% of American households held credit card debt in 2022.

– Expand the child tax credit to help more working-class parents and grandparents raising kids.

– Provide Social Security credit for unpaid work raising young children.

– Update/improve SSI so more people with disabilities can work, save.

– If taxes must go up, hold the working poor harmless.

Click here for longer version including references and related articles.

CCSE work contributes to Congressional hearing on financing Social Security

Center on Capital & Social Equity (CCSE) analysis and advocacy were evidenced during the June 4 House Ways & Means subcommittee on Social Security hearing of the program’s trust fund. Over the past years, CCSE has worked to explore issues affecting low-wage workers and lay groundwork to defend their Social Security benefits when Congress eventually refinances the nation’s most important social program.

It’s Social Security ‘groundhog day’ as trustees repeat annual forecast of declining finances

“…The trustees’ report, however, neglects to mention how Social Security already is impacting the overall federal budget. As pointed out to the Senate Budget Committee, the mechanics of spending down Social Security’s reserves require the Treasury to draw funds from general revenue and issue new debt to the public. As a result, Social Security is gradually and organically moving to paying for current benefits through debt substituting for now-insufficient payroll taxes that it traditionally relies on.”

Missing the obvious: life expectancy in the U.S. is closely related to income – Karl Polzer

“The underlying theory is simple: More income and wealth allow people and governments to support more years of life. Fewer resources put them at a disadvantage. Some politicians who see the connection may be leery of talking about it. Doing so would lead to awkward questions about improving working and living conditions for millions of Americans and dealing with growing economic inequality.

“The strong relationship between income and longevity is clear when comparing states… (E)ight of the nine states with the lowest median household income also are among the bottom nine in longevity. Similar clustering occurs comparing the highest ranked states across the two categories. Seven of the nine states with the highest median household income also are among the top nine in life expectancy.

“Realizing they are rowing in the same economic boat could prompt states to join forces on policy changes, particularly Mississippi, West Virginia, Louisiana, Arkansas, Alabama, New Mexico, Kentucky, Oklahoma, South Carolina, and Tennessee, and others ranking at or near the bottom…

“Presidential candidate and former South Carolina Governor Nikki Haley strongly proposes raising the program’s retirement age on the premise that increased life spans are undermining Social Security’s long-term solvency. If long-held assumptions about longevity were challenged, and potential losses to low-income workers and low-income states caused by raising the eligibility age came to light, would she change her position? Republican candidate Donald Trump, by the way, opposes cuts in Social Security as do most Democrats…”

Thanks to the Washington Examiner for running this op-ed:

Senate minimum wage bills make bipartisan compromise possible – Washington Examiner

For longer version with references, see:

Previous work on this issue:

One way to make living easier in Virginia – letter to WaPost

Yes, raise the minimum wage, but don’t stop there – op-ed

“More Americans are rightly asking if Israel could neutralize Hamas without massive destruction and loss of civilian life. Indiscriminate air attacks by the Netanyahu regime already have killed and injured tens of thousands of Gazans with no end to the violence in sight. To put this in perspective, imagine how Washington, D.C., would look if a foreign government with the power to fence in the District of Columbia dropped a comparable number of bombs here while shutting off access to water and food and destroying most of the capital area’s housing and medical system. UN officials say conditions in Gaza are catastrophic.”

Thanks to the Washington Post for publishing our letter to the editor:

One way to make living easier in Virginia – Karl Polzer/letter to WaPost

“Virginia Gov. Glenn Youngkin (R) told reporters he is ‘concerned about the cost of living in Virginia and we’re continuing to evaluate how best to address that,’ as reported in the Nov. 26 Metro article ‘Budget battle looms in Virginia. Facing a tighter fiscal environment and Democratic control of the legislature, Mr. Youngkin and fellow Republicans could help working families without denting the budget by making an expected Democratic push for a higher minimum wage a bipartisan affair.

“The GOP has been trying to attract more minority and working-class voters. However, party leaders have stopped short of addressing core economic issues, such as supporting higher wages and better benefits, and mainly stress cultural issues…”

Background Information on these issues provided to Virginia legislators

McCarthy & Co. offer themselves up on the cross to help motivate lazy poor people back to work

Work requirements are a policy failure: Why are they still an option? – The Hill

Thanks to the Washington Post for running our letter:

“Letting Americans Down”

“How can House Speaker Kevin McCarthy (R-Calif.), President Biden and Senate leaders claim to represent the working class and poor when Medicaid work requirements are a focal point in the debt ceiling standoff and the Trump-era tax cuts are not? According to the Congressional Budget Office, the work requirements in the Limit, Save, Grow Act would have a tiny impact (about $5.6 billion in fiscal 2025) on the nation’s $31.4 trillion national debt, but they would increase the number of uninsured and state costs and have no effect on hours worked by Medicaid recipients.

“In contrast, ending the Trump-era tax cuts, which disproportionately benefit the wealthy, could put a major dent in the national debt….”

Because most of this site’s readers won’t be able to get through the newspaper’s pay gate, here’s the draft of the letter sent to the Post:

Debt ceiling negotiators focus on a ‘speck’ in benefits for the poor, ignore the ‘logs’ in their own eyes.

“Legislative Choices for Paying Promised Social Security Benefits”

Statement of Karl Polzer, Center on Capital & Social Equity,

U.S. Senate Budget Committee hearing: “Protecting Social

Security for All: Making the Wealthy Pay Their Fair Share”

Has DT crossed the line into delirium tremens?

“It came out of his mouth during a campaign speech last month.”